Ambulatory surgery center ownership models

Introduction

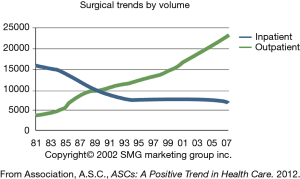

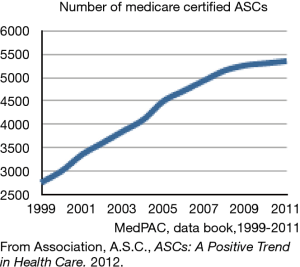

Outpatient spine surgery has grown dramatically over the last decade because of significant clinical and economic advantages to patients, physicians and the health care industry. A desire for cost control, consistent technological advancements and patient and physician satisfaction with ASCs have all been key drivers in this rapid growth. In 1995, just 25 years ago, 80% of surgery was performed in hospitals on an inpatient basis and over 90% of outpatient surgeries were performed in hospitals in hospital outpatient departments (HOPDs). Since then there has been a dramatic shift toward outpatient surgery and in 2015, 64% of surgical procedures were performed on an outpatient basis (Figure 1). There are over 5,300 ASCs in the US performing over 23 million surgical procedures a year (Figure 2) (1,2).

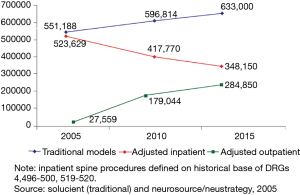

There has been a meteoric rise in the amount of outpatient spine surgery performed over the last decade, as well. From 2005 to 2015, the amount of outpatient spine surgery performed has increased 10-fold (Figure 3) (3). From 2010 to 2015, Blue Cross Blue Shield reported that the proportion of laminectomies done on an outpatient basis grew from 61% to 82% (4). This can be attributed to many factors that have already been discussed in prior chapters. For spine surgery, the advancement of minimally invasive surgery is a key factor. Performing lumbar discectomies, lumbar laminectomies and anterior cervical discectomies and fusions (ACDFs) in the outpatient setting is certainly not a new phenomenon, but it is becoming increasingly more commonplace (5-10). Minimally invasive lumbar fusions cases as well are now being performed in the ASC setting with success (11-13).

Though the clinical advantages of outpatient spine surgery are beneficial, it is the economic advantages that are most convincing. The ASC setting is more efficient leading to greater productivity and lower costs. This has a significant effect on all relevant healthcare stakeholders. Patients can pay less for their care, physicians can share in greater profit and the health care industry, which is in dire need of cost control, has a significant financial opportunity to decrease spending without sacrificing the quality of care.

ASCs can take advantage of the economic benefits that come with specialization. Their smaller size and lesser hierarchy compared to hospitals lead to more focused and consistent management goals and better alignment of incentives of managers and providers. They are “focused factories” as first described by Adam Smith (14). By performing a smaller variety of more specialized procedures they are able to increase efficiency when compared to hospitals. In healthcare as in many other industries, specialization has been shown to lead to lower costs (15).

ASCs have an economic advantage over hospitals as well because of greater autonomy. Compared to hospitals, ASCs have a much greater capacity to pick and choose what procedures they perform, who their patients are, and what processes both clinical and administrative are to be used in their centers. This autonomy results in, proportionately, far less overhead for the facility. Specifically, the lower overhead costs can be achieved by limiting the scope of procedures. This allows for intensified quality control, efficient cost management and strong outcomes while avoiding large-scale demands for space, resources and attention of management. Unnecessary equipment purchases that do not pertain to most of the cases passing through the ASC can be eliminated leading to a lower capital cost. Hospitals are also required to offer ER services and other community services to everyone, including the non-insured. These costs are then passed onto other insured patients, another financial burden that ASCs are able to avoid.

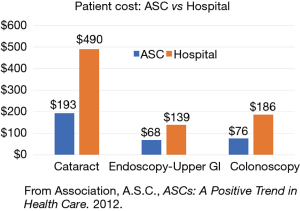

The actual cost savings of outpatient spine surgery are seen in several places. As healthcare costs continue to rise, the financial burden of care is also being shifted more to patients in the form of higher deductible payments and co-insurance. Patients are therefore more aware than ever before of the actual cost of their healthcare. As a result, high cost, elective care such as spine surgery is under significant scrutiny, but this also creates an opportunity for cost savings that only ASCs can take advantage of. Because the same spinal operation can be performed in an outpatient setting with same clinical results, and at a lower cost, patients can benefit both clinically and financially from this effective price decrease. Blue Cross Blue Shield reported an average savings of $320 in out-of-pocket costs for patients undergoing a laminectomy in the outpatient setting compared to inpatient (4). Several other outpatient procedures have been shown to result in lower out-of-pocket costs to patients (Figure 4) (2).

The cost of performing spine surgery in the outpatient setting is lower than in the inpatient setting and there is no greater economic advantage than this simple fact. There are two ways to evaluate costs from the facility perspective, and both are lower in the outpatient setting. Those are the cost to the facility and the cost to the insurance payer, or essentially the price. The cost of surgery to the facility is the actual costs associated with performing the procedure. This consists of fixed costs such as rent, capital equipment and most administrative costs and then the variable costs such as supplies for the case and the staff. In the outpatient setting, fixed costs are significantly lower. ASCs are clearly smaller than hospitals, require less administration and are usually only open for part of the day. Hospitals require a greater administrative burden and must stay open 24 hours a day with an inpatient staff so their fixed costs are higher.

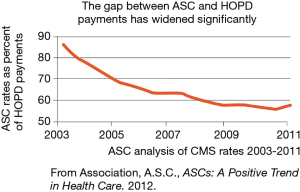

The costs of performing surgery to the payer, or the price of surgery to the health care market is lower in the outpatient setting because of the lower costs of goods involved and the reimbursement systems in place which charge more for inpatient surgery. There is significant data to support this. It is estimated that overall the cost of performing a surgical procedure in an ASC is about 53–55% of the cost of performing the same procedure in a hospital (2,16,17). This discrepancy is increasing over time as well. The Centers for Medicare & Medicaid Services (CMS) applies two different measures of inflation to update each payment system. In 2003, Medicare paid hospitals only 16% more, on average, than it paid ASCs for performing the same procedure. Today, Medicare pays hospitals 82% more than ASCs for outpatient surgery (Figure 5) (2).

For HOPDs, CMS uses the hospital market basket, which measures the cost of medical expenses. For ASCs, CMS uses the Consumer Price Index-Urban (CPI-U), which measures the cost of goods such as milk and bread. Not only is the CPI-U based on changes entirely unrelated to medical costs, the inflation update is historically lower than the hospital market basket (16).

This leads to a significant cost savings currently by doing procedures in the outpatient setting. This amount has been estimated at $37.8 billion in healthcare costs for the commercially insured population in the US (17). The potential for additional savings is even greater. Currently, it is estimated that only 48% of common outpatient procedures are actually performed in ASCs. If the remaining 52% that are now being done in hospitals were moved to ASCs, the additional savings would be $41 billion (17).

Spine surgery performed in an ASC rather than inpatient leads to significant healthcare savings as well. Bekelis et al. examined data from 150,000 patients and found the median charge for a laminectomy done in a hospital was $24,000 compared to only $11,00 in the ASC setting (18). Blue Cross Blue Shield data showed similar differences with an estimated savings of $8,475 for a laminectomy done in an ASC (4). Erickson et al. reported a cost savings of approximately $8,000 for anterior cervical cases performed in ASCs compared to hospitals (9).

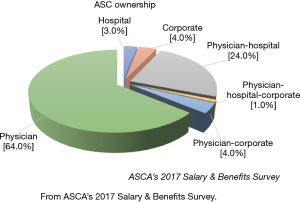

Physicians can benefit significantly as well from ASCs in the form of increased revenue. It is no secret that professional fee reimbursement for physicians has continued to decline over the last few decades. Simultaneously, operating costs and overhead for most physician practices has increased due to many factors including but not limited to higher malpractice rates, electronic health record investments and overall increases in costs associated with health care. This has resulted in a shift of physicians away from private practice and toward employment with hospitals to maintain financial stability but at the expense of autonomy. Revenue generated from ancillaries such as ASCs can offset some of the decline in professional fees that physicians have experienced. Physician ownership in ASCs is both legal and profitable and can be a significant revenue generator. 90% of ASCs in the US have at least some physician ownership. 65% of ASCs are solely owned by physicians (Figure 6) (2). Physician owners performed 49% of the total outpatient spine surgery performed in ASCs in 2014 (19). Physician entrepreneurship and leadership in facilities such as ASCs leads to profit for physicians but also encourages providers to be involved in financial decision making about how to best allocate our limited healthcare dollars.

Along with the economic benefits to physicians and hospitals, outpatient surgery continues to grow and expand because the industry is profitable. The industry is estimated to be over $30 billion and growing at approximately 5% annually (20). The industry is also highly fragmented. The 5 largest ASC management companies own only about 15% of the total ASCs in the US. This has led to a trend of increased mergers and acquisitions in the industry, as is the case with much of the healthcare industry in general. Acquisitions of individual surgery centers or ASC companies typically occur at a multiple of approximately 5–7 times their earnings. These companies are attractive to the investment industry and the mergers are accretive with ASC companies often trading for 7–10 times their earnings on the stock exchange.

Because of this economic efficiency, profitability to the key stakeholders and legal considerations, there are three key players in the ASC ownership space: physicians, ASC management companies and hospital systems. Based on the various interactions between these three key players, there are 5 ASC ownership models to consider. Within each of these 5 unique models there is still a large spectrum of variability of control based on the amount of ownership that each party holds (21-23).

The first model is sole physician ownership. Doctors own 100% equity in the ASC. They are responsible for all management decisions and also control all profits. They may consider utilizing the services of a management company to help with administration, but they do not relinquish equity to them. This remains the most common model but is likely on the decline because of the growing influence of hospital systems.

The second model is a joint venture between physicians and an ASC management company. The actual execution of this model varies greatly depending on who is the majority owner. Physicians can still hold the majority of the equity and therefore be in control of management decisions but have the expertise of an ASC company to aid with execution, contracting, revenue cycle management and various other key issues. Some ASC management companies enter joint ventures with physicians and control the majority of the ownership. In situations such as these, the ASC company may provide greater benefits to grow market share and revenue for the center.

A third model is a joint venture between physicians and a hospital system. As surgery continues to shift from the inpatient to the outpatient setting, hospitals are increasingly entering into these types of ventures to regain market share and lost revenues. Physicians may benefit in these ventures from increased financial stability and better contracts that the hospital system can provide. These arrangements can vary as well based on the role of the majority owner in the venture.

A fourth model to consider is a three-way joint venture between physicians, an ASC management company and a hospital system. All key stakeholders seek to benefit from each other’s expertise and often none is a majority owner to maintain a system of checks and balances. As hospitals grow their involvement in the ASC space and corporations continue to seek the profits from outpatient surgery, there will be more of these ventures and variations. Physician roles continue to evolve as these ventures become more common and creative to align physician producers with the center.

A fifth and final model which is also on the rise is ASCs owned solely by a hospital without any true physician ownership. Physicians are usually contracted for co-management and paid a percentage of revenue for this service. This model is a big part of the growing hospital involvement in ASCs while continuing to attempt to involve physicians in facility fee revenue opportunities and some key clinical decisions.

Though hospital systems and corporate partners continue to grow their presence in the ASC industry, physician ownership remains a key component in all of these models but the last. Even without true ownership, ASCs can likely be successful only with strong input and leadership from physicians.

Physician owned

The most common ASC ownership model is still solely owned by physicians. Approximately 90% of ASCs have some physician ownership and about 65% are solely owned by physicians (Figure 6) (2,23,24). From a legal standpoint, physician ownership in ASCs is permitted as an exception to the Stark laws but there are several regulations as part of the model (25). ASC ownership by physicians must meet the guidelines of the safe harbors of the Stark Laws. The basic guidelines are that physician owners in an ASC should have practices which allow for the provision of medical care in an ASC setting. Physician owners should perform at least one-third of their procedures in the ASC in which they are an owner. Physician investors should pay a fair market value for their ownership shares or percentage in the center (25). These fair market values are usually determined by recent past earnings or projected future earnings with a standard formula that takes into account an earnings multiple for similar centers in the market. Physicians must pay their fair market price and cannot receive a discount based on their volume. This can sometimes provide a barrier to entry to recruiting new physicians to centers performing well financially. When physicians receive distributions, the amount should be based solely on their ownership percentage not on their volume. This also poses a potential conflict if underperformers own a greater percentage and receive higher distributions. This can lead to feelings on inequity among partners. These are just some of the basic rules that physicians must follow with ownership of ASCs and the potential challenges they present in maintaining and growing equitable partnerships.

From an administrative standpoint, ASCs solely owned by physicians must strategize to complete critical business and financial tasks to become successful. Day to day administrative functions must be handled by physician owners or the staff they employ. Contracting with insurance companies can be a difficult process. Physician owned surgery centers may find this particularly difficult because of their smaller size and lack of expertise from a hospital or experienced ASC management company. Nevertheless, there are great benefits to physician ownership such as autonomy and control. This usually leads to a clinical environment with a high quality of care for patients and convenience for physician owners (24). There is a flatter hierarchy which can lead to better access for patients to physician operators who have direct knowledge of the patient’s clinical situation and control over the care environment. Physician entrepreneurs often stimulate innovation and progress.

In order to deal with administrative and contracting issues, ASCs solely owned by physicians may employ a management company without giving up true equity. Usually this would be structured as a management fee that may be based on collections or profit. A standard market rate for this fee varies from about 3–7% of net revenue (21). A hybrid of this model is contracting an experienced management company to provide specific services as needed and pay for those services as they are performed without basing compensation on overall collections or equity (26). The management company can assist with the initial setup when the administrative burden is greater, but after the ASC has been in existence for a while and their operators have gotten experience, they may contract the management company only as needed. The management company can be employed for specific projects as they arise such as accreditation, physician recruitment or center expansion. Physicians may like this flexibility without relinquishing too much control and keeping all equity. This also brings flexibility and makes it easier to remove a company that isn’t performing. The fee is not locked in as a percent of revenue over time but is instead specific to each task performed (26).

Joint venture—physicians and management company

There are many corporations which engage in ASC management and ownership. A common joint venture model is physicians and such a management company sharing in ownership of an ASC. The general principle of joint ownership allows for physician influence on decision making and expertise from the management company for administrative tasks and often for contracting. These companies offer smaller ASCs the capital, economies of scale, administrative support and leverage in payer negotiations needed to remain competitive in their market. There is a great deal of variety in the structure of these models depending on the equity percentage of each owner, particularly which entity owns the majority.

Physician ownership in these ventures is subject to the same regulatory issues as physician ownership in ASCs owned solely by physicians. There are also similar challenges with physician ownership and relationships between partner physicians. New physicians entering the ASC who wish to become owners must buy shares at fair market value. Distributions to physician owners are based on their equity share not on their volume. Physicians are subject to the one-third rule as well, meaning at least one-third of their procedures must be performed at the center. By maintaining ownership and often, the majority of ownership, the physician partners can maintain control of the center and clinical operations. In these ventures, physicians are usually class A shareholders and the management company is class B.

ASC management companies can provide a great deal of value to their partner physicians and by maintaining an ownership in the facility, their profits are directly tied to the success of the center. ASC management companies bring a variety of expertise to these ventures. Some have national managed care contracts which may have rates far superior to those which could be negotiated by the physicians alone. The management company can take over the administrative burden of initial setup, day-to-day management, new physician recruitment and various other tasks which arise. The management company can also serve as an intermediary to help with potential disputes between partner physicians. In situations where the physician partners still maintain the majority of the equity they would still have the final decision-making power.

The ASC management space is profitable, growing and fragmented. The biggest players in the space are United Surgical Partners International (USPI)/Tenet Healthcare, Amsurg, Surgical Care Affiliates (SCA), Hospital Corporation of America (HCA) and Surgery Partners (27-29). Their ownership models vary greatly. According to a recent survey of ASC management companies, fifty percent of management companies prefer a 29 to less than 10 percent ownership stake, while 50% prefer a 30 to 75 percent ownership stake (21). Some companies such as SCA prefer to maintain a minority stake between 20–49% and allow physician owners to maintain the majority stake (27,28). Others such as Amsurg have a typical model of 51% ownership (28,29). When a management company owns a greater than 50% share in a surgery center it has control and may and try to consolidate for the purpose of going public or making another type of majority transaction at some point. There is an increasing amount of merger and acquisition activity in the space because of the profitability and the fragmented nature of the market.

Though management companies have much to offer, areas of expertise vary across the industry. Certain companies have significant proficiency in managed care contracting, while others have no real power of influence in this area. Management companies also by and large cannot help increase the number of cases. There are exceptions such as Nobilis Health which engages in significant direct to patient marketing and can therefore increase cases to physician partners. Some ASC companies are also more adept than others in physician recruitment. When physicians enter into these joint ventures, if they are willing to give up equity to a management company, particularly if it is the majority of equity, they should choose a company which can add value to the center through expertise in not just management but also case volume, physician recruitment or managed care contracting.

Joint venture—physicians and hospital

There is no trend in the ASC environment perhaps more dominant than the growing involvement of hospital systems. Hospitals are increasingly seeking joint ventures with physician partners to recoup lost volume that has moved away from larger hospitals to the more efficient ASC environment. Physicians look to benefit from these ventures primarily from the increased financial stability that the hospital likely can bring and the better insurance contracts for reimbursement (21,25,30).

There is also a great deal of variety in this ownership model depending on the majority owner. When physicians own the majority, they are the class A shareholder with over 50% of the equity and therefore have operational control over key decisions such as credentialing, partnership decisions, capital expenditures and budgeting. Hospitals may be willing to seek this minority position if they have lost significant volume to the ASC and may prefer some involvement in these cases and alignment with the physicians rather than continuing to lose more outpatient volume to the center (23). The hospital may also benefit from transitioning their own cases from their inpatient operating rooms to their ASC in order to free up inpatient operating room space for more complex procedures when capacity is a concern. Hospitals also benefit in partnering with physicians to increase alignment with independent groups who might otherwise not work with the hospital much at all. Hospitals can bring their own expertise in health care management and data-driven decision making to the partnership while still allowing physicians to be involved in operational control (31).

The hospital taking a majority ownership position can bring some significant advantages to the joint venture. Hospital involvement can lower supply costs by leveraging existing supplier relationships and volume-based discounts. Hospitals can offer their own employed physicians some of the benefits of the ASC such as increased efficiencies to allow for more surgical volume and less turnover time, as well as the higher patient satisfaction usually seen in the ASC setting (32,33). Hospitals may benefit the venture with improved retainment and recruitment of physicians, enhanced market share and access to greater starting capital. Physicians might seek this relationship and relinquish majority control to a hospital even if not employed because of greater long term financial stability with hospital involvement and better contracts with insurance companies for reimbursement which is likely the single biggest advantage of a hospital majority control model (21,23). Critics of this model may argue that managing a hospital is very different than managing an ASC so the hospital might not have the right expertise and might not take advantage of the efficiencies of other ASCs. Because of this issue and the reservations of physicians giving up too much control to hospitals, a three-way joint venture model between physicians, hospitals and a management company is on the rise.

Joint venture—physicians, hospital and management company

As the ASC market evolves, newer and more creative models are arising such as a three-way joint venture between physicians, management company and hospital system. All three parties bring something to the venture. Physicians are the key producers and involving them in ownership is crucial to success and clinical oversight. Experienced management companies can bring their expertise in financial matters, operations and physician recruitment. As hospitals continue to become more involved in the ASC environment, they enter into these types of ventures and likely bring better contracts for greater financial stability and are willing to give up equity to a management company for their greater expertise and experience driving operational success.

The structure of this ownership model can vary. It is common for none of the partners to have a complete majority of ownership to maintain a system of checks and balances. In most situations the physicians would own less than 50% and the hospital and management company own a majority stake together. This is usually better for managed care contracting. In that typical scenario, the hospital and management company have their own partnership in a holding company. The hospital would have the majority share in the holding company, typically 51% and the management company would own 49% of the holding company. That holding company will own between 51% and 60% of the ASC with the physicians owning the remainder (21,23). In some other situations, the hospital and management company may have a minority ownership in the joint venture.

Hospital owned with physician co-management

The newest model in ASC ownership is sole hospital ownership with physicians being compensated for co-management of the facility. Growing hospital involvement in the ASC space as a dominant trend has been discussed. Hospitals seek to recapture lost outpatient cases to independent ASCs. Co-management agreements with physicians are an ideal way to align incentives to drive volume to their own ASCs. In a typical co-management agreement, the physicians do not have equity in the center but receive a flat fee for assisting in various aspects of management designed to increase and oversee the quality of care at the ASC. The hospital bears the entire financial risk of the operations. These ASCs have the potential to be the highest reimbursing with hospitals taking advantage of their more profitable HOPD rates with insurances (21,23).

Co-management agreements are growing in popularity for various reasons. These agreements are quality-oriented pay-for-performance based arrangements. Physicians become partly responsible for the quality of care, patient outcomes and other key clinical metrics. Hospitals maintain their role in managing finances, marketing and personnel issues. As healthcare moves toward value-based care these types of arrangements which ultimately seek to improve quality and align incentives of all parties are becoming more common. In these agreements, physicians are compensated for the time they dedicate to managing care processes. The compensation must be based on a fair market value of their time and efforts and not on their referrals. This can be structured as a base fee with performance incentives. These metrics must be clearly specified and tracked. In some agreements, the compensation may also reflect a percentage of collections, typically 2–8% of net revenues. Similar agreements are found in hospital systems with physicians or groups of physicians being involved in co-management of a particular service lines (21,23,34).

Conclusions

Shifting the site of surgery from the inpatient to the outpatient setting is the most important trend in healthcare in the last two decades and the shift has really only begun. This shift brings the greatest potential for healthcare cost savings that we have seen in our lifetimes. There is no reason to perform many surgical procedures in a costly inpatient setting when they can be performed in a more efficient, less expensive outpatient center which actually provides better care to the patient.

This shift toward outpatient surgery has created an immense, profitable and growing market for ASCs. Corporations who specialize in owning and operating ASCs are fighting for market share in this profitable environment and merging to gain traction and influence. Hospital systems which had fallen behind initially are now re-doubling their efforts to join the ASC space and looking for joint venture opportunities to gain a foothold. Physician owners in ASCs have the advantage of still maintaining the majority position in ASC ownership but have significant challenges with rising costs, increasing administrative burdens and declining managed care contracts. As a result of these factors, ASC ownership models will continue to trend towards more creative joint ventures between physicians, ASC corporations and hospital systems which can each benefit from the other. Physicians must continue to maintain a leadership role in ASC ownership as it is in the best interest of patients, physicians and the healthcare industry.

Acknowledgements

None.

Footnote

Conflicts of Interest: The author has no conflicts of interest to declare.

References

- AHA. Trendwatch Chartbook: Trends Affecting Hospital and Health Systems 2015. Available online: https://www.aha.org/guidesreports/2018-05-22-trendwatch-chartbook-2018

- Association ASC. ASCs: A Positive Trend in Health Care 2012. Available online: https://www.ascassociation.org/advancingsurgicalcare/aboutascs/industryoverview/apositivetrendinhealthcare

- Healio. With the growth of outpatient orthopedic spine surgery, more research is warranted. Orthopedics Today. 2015. Available online: https://www.healio.com/orthopedics/spine/news/print/orthopedics-today/%7Ba97055c2-d786-465f-b195-2221d2ec6f93%7D/with-the-growth-of-outpatient-orthopedic-spine-surgery-more-research-is-warranted

- Shield BCB. How consumers are saving with the shift to outpatient care 2016. Available online: https://www.bcbs.com/the-health-of-america/reports/how-consumers-are-saving-the-shift-outpatient-care

- An HS, Simpson JM, Stein R. Outpatient laminotomy and discectomy. J Spinal Disord 1999;12:192-6. [PubMed]

- Baird EO, Egorova NN, McAnany SJ, et al. National trends in outpatient surgical treatment of degenerative cervical spine disease. Global Spine J 2014;4:143-50. [Crossref] [PubMed]

- Zahrawi F. Microlumbar discectomy. Is it safe as an outpatient procedure? Spine (Phila Pa 1976) 1994;19:1070-4. [Crossref] [PubMed]

- Stieber JR, Brown K, Donald GD, et al. Anterior cervical decompression and fusion with plate fixation as an outpatient procedure. Spine J 2005;5:503-7. [Crossref] [PubMed]

- Erickson M, Fites BS, Thieken MT, et al. Outpatient anterior cervical discectomy and fusion. Am J Orthop (Belle Mead NJ) 2007;36:429-32. [PubMed]

- Silvers HR, Lewis PJ, Suddaby LS, et al. Day surgery for cervical microdiscectomy: is it safe and effective? J Spinal Disord 1996;9:287-93. [Crossref] [PubMed]

- Chin KR, Coombs AV, Seale JA. Feasibility and patient-reported outcomes after outpatient single-level instrumented posterior lumbar interbody fusion in a surgery center: preliminary results in 16 patients. Spine (Phila Pa 1976) 2015;40:E36-42. [Crossref] [PubMed]

- Emami A, Faloon M, Issa K, et al. Minimally Invasive Transforaminal Lumbar Interbody Fusion in the Outpatient Setting. Orthopedics 2016;39:e1218-22. [Crossref] [PubMed]

- Chin KR, Pencle FJ, Coombs AV, et al. Lateral Lumbar Interbody Fusion in Ambulatory Surgery Centers: Patient Selection and Outcome Measures Compared With an Inhospital Cohort. Spine (Phila Pa 1976) 2016;41:686-92. [Crossref] [PubMed]

- Smith A. An inquiry into the nature and causes of the wealth of nations. Dublin: Whitestone; 1776.

- Eastaugh SR. Hospital costs and specialization: benefits of trimming product lines. J Health Care Finance 2001;28:61-71. [PubMed]

- Association ASC. The ASC Cost Differential 2016. Available online: https://www.ascassociation.org/advancingsurgicalcare/reducinghealthcarecosts/paymentdisparitiesbetweenascsandhopds

- Bluebook ASCAH. Commercial Insurance Cost Savings in Ambulatory Surgery Centers 2016. Available online: https://www.ascassociation.org/advancingsurgicalcare/reducinghealthcarecosts/costsavings/healthcarebluebookstudy

- Bekelis K, Missios S, Kakoulides G, et al. Selection of patients for ambulatory lumbar discectomy: results from four US states. Spine J 2014;14:1944-50. [Crossref] [PubMed]

- Baird EO, Brietzke SC, Weinberg AD, et al. Ambulatory spine surgery: a survey study. Global Spine J 2014;4:157-60. [Crossref] [PubMed]

- Frack B, Grabenstatter K, Williamson J. Ambulatory Surgery Centers: Becoming Big Business L.E.K. Consulting/Executive Insights; 2017. Available online: https://www.lek.com/insights/ei/ambulatory-surgery-centers-becoming-big-business

- Becker S, Pallardy C. 5 Surgery Center Joint Venture Models. Becker's ASC Review 2013. Available online: https://www.beckersasc.com/asc-transactions-and-valuation-issues/5-surgery-center-joint-venture-models.html

- Becker S, Health V. ASC Ownership Trends in 2017: More Complex Joint Venture Deals. Becker's Hospital Review 2017. Available online: https://www.beckershospitalreview.com/hospital-transactions-and-valuation/asc-ownership-trends-in-2017-more-complex-joint-venture-deals.html

- Becker S, Health RS. An Examination of Ownership of ASC JVs. Becker's Hospital Review 2011. Available online: https://www.beckershospitalreview.com/hospital-physician-relationships/an-examination-of-ownership-models-of-asc-jvs.html

- ASCA. Benefits of Physician Ownership. Advancing Surgical Care 2018.

- Strode R. The Resurgence of the Ambulatory Surgery Center: Seven Considerations for Ownership. Health Care Law Today 2018. Available online: https://www.healthcarelawtoday.com/2018/05/24/the-resurgence-of-the-ambulatory-surgery-center-seven-considerations-for-ownership/

- Nantz J. The Alternative Ambulatory Surgery Center Management Model: 6 Things to Know. Becker's ASC Review: ASC Turnarounds: Ideas to Improve Performance; 2015. Available online: https://www.beckersasc.com/asc-turnarounds-ideas-to-improve-performance/the-alternative-ambulatory-surgery-center-management-model-6-things-to-know.html

- Rechtoris M. The 5 ASC powerhouses: 35 things to know about the largest surgery center chains. Becker's ASC Review 2016. Available online: https://www.beckersasc.com/asc-transactions-and-valuation-issues/the-5-asc-powerhouses-35-things-to-know-about-the-largest-surgery-center-chains.html

- Becker S, Pallardy C, Rizzo E. HCA, SCA, AmSurg, USPI & Symbion: 5 Key Facts About 5 of the Largest ASC Companies. Becker's ASC Review 2014. Available online: https://www.beckersasc.com/lists/hca-sca-amsurg-uspi-symbion-5-key-facts-about-5-of-the-largest-asc-companies.html

- Yetter E. The Most Active Ambulatory Surgery Center (ASC) Buyers. Physicians First 2017. Available online: https://www.physiciansfirst.com/blog/the-most-active-ambulatory-surgery-center-asc-acquirers

- Becker S, VMG-Health. ASC Ownership Trends in 2017: More Complex Joint Venture Deals. Becker's Hospital Review 2017. Available online: https://www.beckershospitalreview.com/hospital-transactions-and-valuation/asc-ownership-trends-in-2017-more-complex-joint-venture-deals.html

- Flanigan B, Elsner N. Six physician alignment strategies health systems can consider. Deloitte Center for Health Solutions 2018. Available online: https://www2.deloitte.com/content/dam/Deloitte/us/Documents/life-sciences-health-care/us-lshc-six-physician-alignment-strategies.pdf

- Network SC. Hospital or ASC. What's the Difference? 2016. Available online: https://surgerycenternetwork.com/hospitals-vs-ascs

- Press-Ganey Associates, “Outpatient Pulse Report,” 2008.

- Becker S. 5 Things to Know About Co-Management Agreements. Becker's Hospital Review 2014. Available online: https://www.beckershospitalreview.com/hospital-physician-relationships/5-things-to-know-about-co-management-agreements.html